I bet this is the first time you've seen a post begin with a mathematical formula. But it was trailed yesterday, so you should have had some idea of what's coming. It's to do with mortgage repayments. Not I know the most elevating of topics, but that's the precise point. There I was , some 40 years ago, straight out of University, despairing of ever being able to buy a house of my own on what Quaker Oats were paying me as a research assistant. And then there was all that interest to pay. But how much, in total ? I hadn't a clue how the system worked, or how the sums were done, and didn't have the inclination to go into a Building Society and ask, given I had no immediate intention of buying a house, far less a deposit to put down. So I was thrown back on my own slender mathematical resources, comprising GCE O-Level, one year of further maths , and a bit of topping up at University.

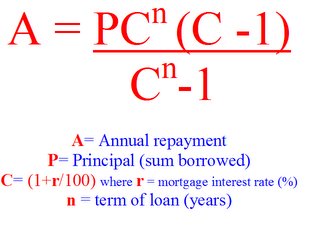

Well, as the formula above shows, I finally got there. To this day I recall the magic moment when I realized how to convert a page of scribbles into that neat compact formula. OK, I know its not e=mc2, but for a moment or two I felt, if not like Einstein, well, like a million pounds. And it didn't need any post O-Level maths either. Just some background in compound interest calculations, and the ability to spot and deal with a geometrical series.

Allow me first to show you how the formula works, where I input numbers, pulled from the air and I'll then give a clue as to how it was arrived at.

Suppose, for example, one needs to borrow, at today's prices, £200,000 over 25 years . Let's suppose you take a fixed rate, say 6.5 % . Then one substitutes P=200,000, and for the C term one first calculates (1 +6.5/100) ie 1.065. The annual repayment A is then calculated as 200,000 times 1.065 raised to the power of 25 times (1.065 - 1), all divided by (1.065 to the power of 25 , minus 1).

You'll need a good calculator, obviously, one that can handle powers ( ie with a key labelled x to the power of y) . Assuming you have not, or possibly have more important things to do with your life (though what those are I truly cannot imagine) , then I'll do the number-crunching for you. The answer works out at :

Phew ! And that's not counting what has to be the found by way of a deposit, stamp duty, legal fees, furnishing etc.

But I didn't stop there. I knew, of course, as everyone does, the way a repayment mortgage drags its feet in the early years, ie gets off to a painfully slow start as far as reducing the amount owed is concerned.

The first few annual payments are doing little more than repaying interest, with only a small reduction in the "principal". But that wasn't good enough for me. I wanted to know precisely what I would still owe at 5 years, 10 years etc.

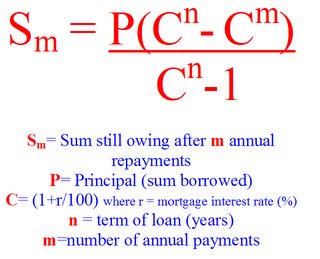

Actually, the difficult bit was already done , so it was fairly simple to arrive at this:

S, with the subscript m, is the amount that is still owed after, say, m years. P and C and n have the same meanings as before. So let's try putting m equal to 5 and 10 years respectively, and see what we get.

S, with the subscript m, is the amount that is still owed after, say, m years. P and C and n have the same meanings as before. So let's try putting m equal to 5 and 10 years respectively, and see what we get.After 5 years, having borrowed £200,000, and paying 6.5% interest as before, one still owes: £180,663.

And after 10 years it is : £154,169

Depressing thought , isn't it, that after 10 years, less than a quarter of the loan is repaid. These calculations were enough to dissuade me from rushing into house purchase back in the late 60s. But house price inflation, much above 3 or 4 percent a year, was unknown then, so property purchase was not seen as a way to make quick capital gains. Shame, perhaps, that I didn't put a foot on the ladder then - I'd probably be living on the Cap d'Antibes today, rather than in the Town. But then I tell myself that the shops, restaurants, the life, the buzz are all here right on my doorstep, together with the unmentionables. I use my walks round the Cap where others might pop tranquillisers or anti-depressants. Pity about not having a garden, though. And as for other people's dogs, and what they do outside my door ......

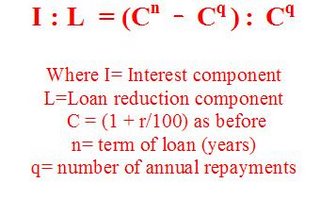

I was also able to derive a formula for working out what each annual payment represents in terms of interest and loan repayment, and how that ratio gradually shifts from being primarily interest to being primarily loan repayment. As is so often the case in maths, the final answer is elegant in its simplicity.

Using this formula, one can show that of each pound paid to the loan-provider in the 5th year, about 72p is interest, and 28 p is loan repayment.

But at 20 years, it's roughly the same, but the other way round : every pound repaid is 27p interest, and 73p loan repayment.

Congratulations all those of you, Sarah, who've made it so far. Time for all/both of us to take a break. I shall add a second instalment this later in the morning, just to round it off a little less abruptly.

PS: On second thoughts, I think it best to leave it as it is - no sense in over-egging the pudding.

I didn't know there was egg in a suet pudding.

I spent this morning making a list of topics for future posts. Given the liberal way in which I am interpreting the D&D theme (through necessity more than by choice) there's plenty to keep this blog going for weeks if not months to come. OK, so it doesn't attract Comments, but too many might distract from the job in hand. Mind you, the odd one or two would be welcome ....don't want to have people saying he's talking to himself, do we hippo ? So at present I'm content just to build up a portfolio of posts on anything that is perhaps a bit off the beaten track, quirky even. But we Brits don't do quirky, do we hippo ?

No, we're all of us paragons of sanity

Anyway, it's back to aerial spotting tomorrow. I'm going to show some pix I took on a flight from Casablanca to Nice last spring, and how I was able to figure out (later) what I was seeing on the ground, using a map, ruler and the internal clock on my digital camera.

Oh my God ......... Head for the hills, everyone.

PPS Re the equations: if you know any mathematicians/ maths teachers etc, do please ask them to check this out. But I'm 100% confident of these self-derived formulae, for the reason stated. They are too simple, too "right-looking" to be wrong. That's what I like about maths. Others have described their passion for the subject as being like a vision of cool, clear, clean mountain air. Sibelius for the numerate !

No comments:

Post a Comment